The way banks determine your outgoing expenditures

Over the past 5 years, banks have been steadily lending out less and less compared to previous years. There has been lots of discussion out on the media and in the market about the crack down on bank’s living expense and liabilities.

Over the past 5 years, banks have been steadily lending out less and less compared to previous years. There has been lots of discussion out on the media and in the market about the crack down on bank’s living expense and liabilities.

Over the past year, the Australian economy has felt the economic impacts of the Royal Commission reviewing the culture and practices of the Australian banks. With the magnifying glass pointed towards the banks, they have further tightened their lending policy and the way that they would assess potential new business. They are now required to complete an in-depth financial analysis through both general spending and other outstanding debts before lending money out. This change the main reason why required documentations for loans have increased over the years.

Understanding the formula the banks use to assess outgoings is the first step to structuring your accounts in a way that will best help you obtain a loan.

Living Expenses:

Living expenses have been one of the most heavily monitored areas by the banks when offering out new loans. The banks are required to complete an in-depth analysis of your financial position and spending habits to determine whether offering you the new loan will be putting the client into a worse financial position.

The crackdown on living expenses is now requiring at least 3 months of transactional account statements so both bankers & brokers can assess your spending habits over that period. This period may be required to increase to a year depending on potential further finance restrictions.

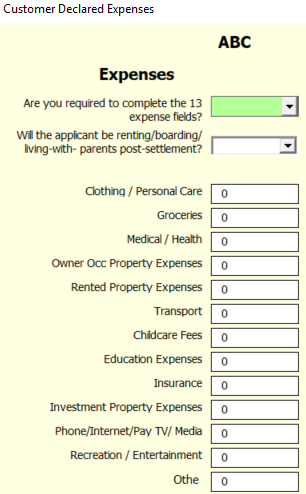

Living expenses is split into at least 9 categories, sometimes 13 depending on the bank requirement. Most clients have no idea what they spend in these categories which could potentially lead to under-estimating spending habits.

Underestimating spending habits could have multiple negative impacts upon your loan. Firstly, the loan could be declined as the banks will go through your financial statements to determine your actual spending habits compared to your estimated amount. This is because if your actual spending amount was much higher than what you declared, then the banks would be putting you into a worse financial position by offering this loan product. Secondly, even if the loan was approved, you would either be required to change your living habits or steadily be put into a position where you are unable to repay your loan. Being unable to repay your loan would negatively affect your credit score and credit file, but at the same time potentially restrict further credit applications in the future while losing substantial money.

However, in the case where you spend lower than the baseline figure determined across the finance industry. The banks will still use the baseline figure as compared to the lower actual figure. For example, a client on $80k income who is currently living at home with parents paying for majority of outgoings, client is also not paying any rent and would potentially only spend around $500 monthly which is evident through last 3-month bank statement review. The banks would have to use the baseline figure of $1600 as living expenses + living at home costs which ranges from $500-$650 depending on the bank. Therefore, total living expenses that the banks will assume this customer will have is $2100 – $2250 as compared to the actual living expenses of $500 monthly.

As living expenses is scaled off income. It is important to know what the baseline living expenses is for your income category and adjusting your lifestyle to that amount in order to smoothly obtain a loan for purchasing a new property. It is recommended to speak to a licensed mortgage broker to help you with those steps.

Liabilities:

- Mortgages – All banks are now required to know if you have any outstanding mortgages while applying for the new loan. Depending on the institution, they may require evidence in the form of bank statements, however most banks would be able to determine your position through a credit check.

Most banks assess current loan repayments at a much higher interest rate than what you are paying for it. For example, for a $1M current loan, you will be required to pay roughly around $4800 monthly based on a 4% interest rate whereas the banks would be calculating a monthly repayment of close to $7000. This is an additional buffer that banks put in place, which may explain why you can borrow less than you originally thought.

- Credit Cards – Most people are recommended to obtain a credit card when they are younger to start building a credit score. However, a credit card will have negative impact on your borrowing capacity. When a bank assesses your current credit card, they assess your card limit and not the way you spend. For example, if you have a $20,000 credit card where you only use $1500 monthly. The banks will still assume that you have a $20,000 debt because you can spend up to $20,000 at any given time despite your past transactional record. Having a credit card is not a bad thing, but it is important to keep the balance between maximising your borrowing capacity while not limiting your living standard.

- Car Loan/Personal Loan – These loans take a fixed amount out of your income every repayment frequency. This amount must be considered as these are fixed outgoings every repayment frequency. It is important to understand the potential negative impacts of these repayments on our borrowing capacity and work towards a balance where you can achieve your financial goals.

- HECS/HELP Debt – Most Australian born or raised clients that have gone through further education will have accumulated some sort of HECS or HELP debt. During the studying years, these clients do not consider the impact of these debts and how they could potentially restrict your future borrowing capacity. As these debt repayments become a fixed repayment scaled off your income once you start earning, it is important to see how big of an impact these loans can be.

For example, if you are on $80,000 annual income and you have a HECS debt of $30,000. Your annual HECS repayment will be $4400, which breaks down to $367 roughly monthly. This repayment is equivalent to having an extra $12,200 credit card.

It is important to understand the impacts that the changes to both living expenses and liability assessment that will have on your loan application. Once clients understand these impacts, they are able to pre-emptively restructure their spending habits to put themselves into a stronger borrowing position when they are looking to buy a property.

- Posted by AUSUN Finance

- On April 5, 2019

- 0 Comment